Passwords, 2FA, and More

Managing money online has never been easier—but it also means your accounts are attractive targets for cybercriminals. From weak passwords to phishing scams, even a small slip can put your financial information at risk. The good news? With a few smart habits, you can dramatically strengthen your online security.

Step 1: Build Strong, Unique Passwords

- Avoid easy guesses. Skip birthdays, names, or simple sequences like “1234.”

- Use length + complexity. A strong password should be at least 12 characters with a mix of upper and lowercase letters, numbers, and symbols.

- Don’t reuse across sites. If one account is breached, it can put all your accounts at risk.

Tip: Consider using a reputable password manager to securely generate and store complex passwords.

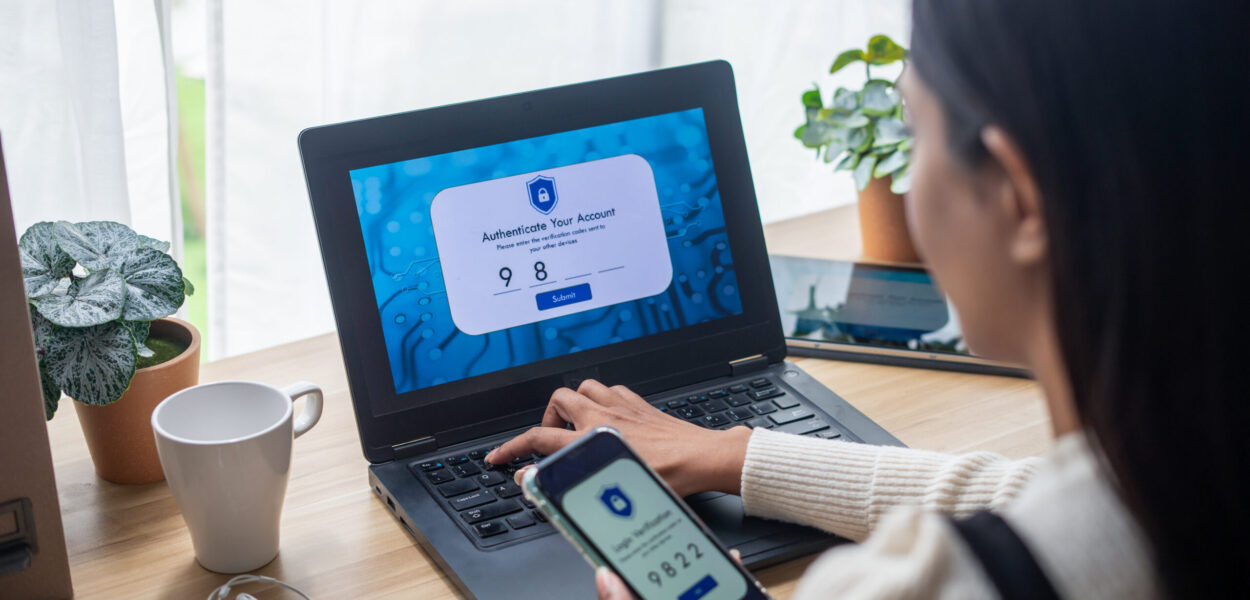

Step 2: Turn On Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of protection by requiring something you know (your password) plus something you have (a code sent to your phone or generated by an app).

- Use app-based code (like Google Authenticator or Authy) instead of SMS when possible.

- Enable 2FA on your financial accounts, email, and any site that stores sensitive information.

Step 3: Be Alert for Phishing Scams

Scammers often pose as trusted institutions, urging you to click a link or provide account details.

- Check sender addresses carefully. A single misplaced letter can signal a fake.

- Never click suspicious links. Type in the URL manually or use your saved bookmark.

- Remember: Your credit union, bank, or legitimate business will never ask for passwords or full Social Security numbers over email or text.

Read and become familiar with other types of scams so you can protect your finances.

Step 4: Secure Your Devices and Networks

- Update software regularly. Install updates for your phone, computer, and apps to fix security flaws.

- Use secure Wi-Fi. Avoid logging into financial accounts on public Wi-Fi unless using a trusted VPN.

- Set device locks. A PIN, password, or biometric lock adds another barrier.

Step 5: Monitor Your Accounts

- Check transactions often. Report anything suspicious right away.

- Enable account alerts. Many financial institutions offer email or text notifications for logins and large purchases.

- Review credit reports. Free annual reports from Equifax, Experian, and TransUnion can help catch fraud early.

Bottom Line

Protecting your finances online doesn’t require advanced tech skills, just consistent, smart habits. Strong passwords, two-factor authentication, and scam awareness go a long way toward keeping your money and identity safe.

Want help setting up secure account access or have concerns about online safety? Visit IC Credit Union ‐ Get in Touch to connect with us today.